What is Retail Media?

Retail media is advertising to consumers at or near their point of purchase, or point of choice between competing brands or products. Today this includes digital media as well; advertising within retailer websites and apps typically by brands that directly sell products with retailers, retail media advertising can also come from brands in verticals such as those that are interested in the retailer’s audiences but don’t necessarily sell products on those retailers’ sites and apps.

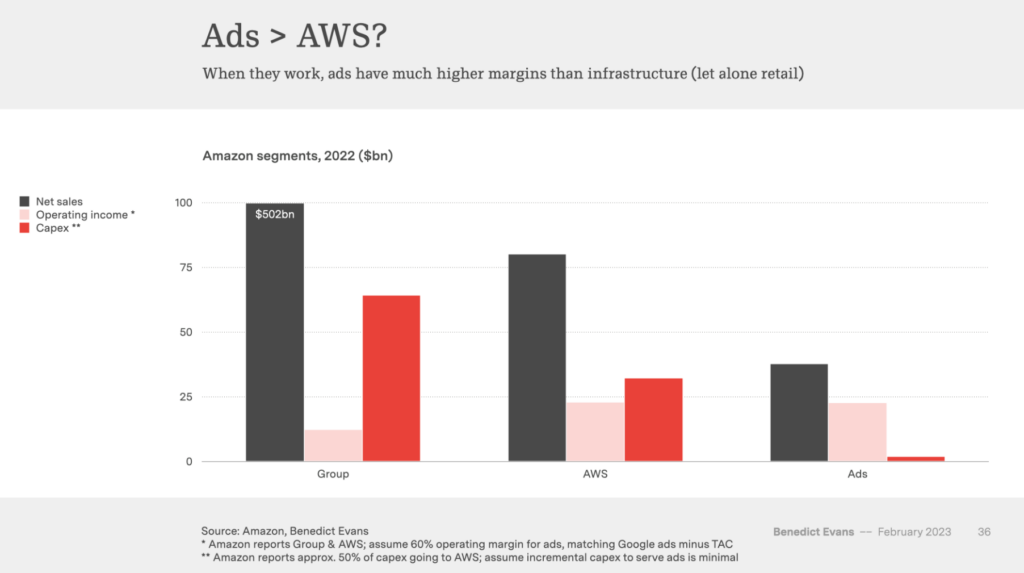

Classical retail players are chasing the returns of early movers like Amazon get from their Amazon Ads platform, the returns on which are assumed to be higher than either their Prime or AWS business units:

A retail media business also gives retailers and suppliers access to something more valuable: insights about consumer preferences and behavior that can help improve messaging, define digital marketing strategy, and deliver a direct link from ad impression to sale via first-party data—and with third-party tracking being phased out, the demand for this kind of accuracy is only expected to rise.

A report released in December showed that retail media is one of the fastest growing sectors within the digital advertising industry; 92 percent of advertisers and 74 percent of agencies are already partnering with retailers to reach consumers, and of the small groups not engaged with retail media as an advertising channel, 88 percent of advertisers and 77 percent of agencies state they plan to do so in the next 12 months.

Who’s running Retail Media Networks?

Numerous leading retailers offer advertising solutions on their e-commerce properties. Amazon Ads kickstarted things and have since been joined by retailer offerings from Best Buy Ads, Costco Wholesale, eBay Ads, The Home Depot Retail Media+, Instacart Ads, Kroger Precision Marketing, Macy’s Media Network, Roundel (Target), Walmart Connect, and Wayfair Media Solutions in the United States. In Europe, Otto, Zalando, Tesco, Sainsbury’s, and Boots are some of the retailers with their own offerings. Even Uber is in on the game.

How does Media Retail Advertising work?

Retailers either have their own self-service advertising platforms, like Amazon’s Amazon Ads, or they use a third-party platform like those offered by Citrus Ads, Criteo, or Dunhumby. The platforms allow agencies and brands to run digital marketing campaigns using a range of ad placements and creatives via your typical Cost-Per-Click (CPC) auction model.

The platforms provide measurement which enables advertisers to measure success across a range of different KPIs from awareness through to conversion built on the retailer’s first-party data collected from their customers while they’re signed in to the retailer website.

As the usefulness of third-party cookies approaches an end—an approach that Google keeps extending—first-party-data-based advertising and measurement solutions are experiencing increased demand from advertisers.

Data Clean Rooms

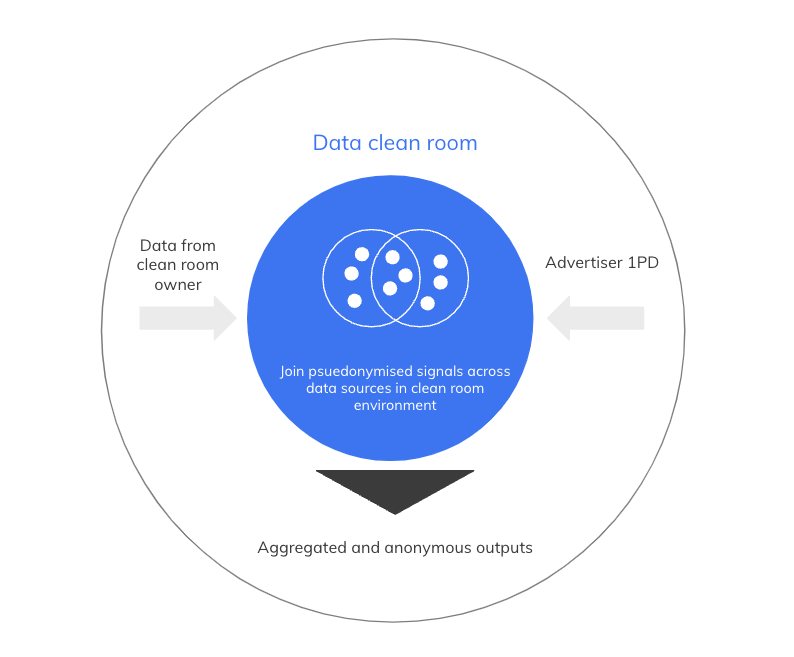

A newer offering from many Retail Media Networks is a data clean room solution. Data clean rooms are cloud-based data warehouses where first-party data from two parties can be uploaded and queried by either party to deliver aggregated results for advanced analysis use cases (read: data science) including:

- Audience analysis: explore how audiences and customers overlap, providing valuable aggregate insights without the underlying data being visible to either party

- Reach and frequency measurement: providing the ability to deduplicate campaign reach and frequency for better media planning and measurement

- Cross-platform attribution: enabling partners to conduct their own self-service multi-platform attribution across the retail media online and physical stores from advertiser data

There are two main types of clean rooms: media clean rooms and partner clean rooms. Media clean rooms include Google’s Ads Data Hub and Amazon Ad’s Amazon Marketing Cloud. Partner clean rooms are built on third-party software and governed by an agreement, usually something legal and lengthy, between two parties and built using a third-party like Snowplow, Habu, Harbr, InfoSum, or Decentriq.

Final Thoughts

The benefits of first-party data for targeting and measurement are attractive: being able to make use of retailers’ first-party data assets as an alternative to third-party cookies will offer a high-quality understanding of audiences and their purchase behavior. The strength of the audience data that retail media provides enables use cases beyond sales including all manner of brand advertising.

Measurement won’t be straightforward: creating a consistent picture of performance across multiple retailers will be challenging with differing measurement rules across different platforms and that’s before you consider companies that use different media or performance agencies for the same platform in different markets and the likely absence of contractual agreements to share, access, or analyze data from markets in which they don’t operate.

There’s also a question of user privacy: specifically where data clean rooms are concerned; the majority of user data privacy legislation contains a purpose limitation clause whereby you can only use data for a specific purpose that the user has consented to. Do companies need to add a new purpose to their privacy policies and consent management platforms to allow user data to be aggregated and analyzed across different websites or will an existing lawful basis be suitable? As with much of today’s privacy-focused AdTech solutions, we’ll only really know if or when it’s challenged in court.