In this age of the hyperconnected customer, information search and convenience are the ultimate currencies. Customers today are actively seeking ways to gain more and more information about the products or services they’re interested in buying. With the increasing prominence of web-connected mobile devices, they can effortlessly access all the information they want, right at their fingertips at any time of the day. This explains the customer actions and media disruption during various stages of the purchase cycle (i.e. hopping from online to offline, or vice versa, before and during shopping excursions to find out more about products and services of interest – and above all, to compare prices).

The days of linear customer journeys are over! Here’s a snapshot of a typical purchase journey for today’s hyperconnected customers.

Unfortunately, most of the brands fail to capitalize on this and lead consumers down confusing purchase paths instead of simplifying and personalizing the route via “decision simplicity”—the ease with which consumers can gather trustworthy information about products and services of interest.

In this article, we’ll explain the transition of customers to the research online, purchase offline (ROPO) shopping model and discuss various advantages it can offer to CPG brands. We’ll also outline the key challenges in tracking ROPO ROI and guide you on how best to connect information search of potential customers with CPG purchases at brick and mortar stores, thereby helping you leverage ROPO to drive in-store product sales for your brand.

What is the ROPO effect?

Research online, purchase offline, is a modern trend in buying behavior where customers research relevant product information online, compare prices, and read through online reviews to qualify their buying decision before making an in-store purchase. This research can be done prior to stepping foot in a retail store or on smartphones while walking through the store’s aisles.

Most brands and retailers agree that online search makes a significant contribution to sales in physical stores. Nevertheless, they have been struggling for years with the question of how to gain insight into this ROPO effect and leverage it to their advantage.

Examining the ROPO Behavior – CPG vs Other Product Categories

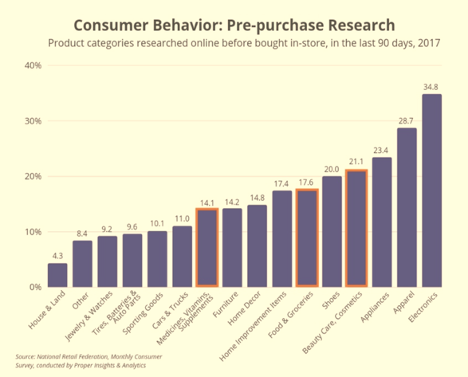

Different sectors and different product types drive ROPO behavior in varying ways. While Electronics, Apparel and Appliances are the most popular ROPO categories, the percentage of ROPO purchases in CPG is too large to ignore. As illustrated, a significant proportion of CPG shoppers start their product discovery process online to guide in-store purchase for categories such as Beauty Care and Cosmetics, Food and Groceries, and Medicines, Vitamins and Supplements.

These CPG shoppers do their “Research Online” to get a feel for the product range, compare prices, search for deals/promotions/coupons and even make comparisons that determine which store they will ultimately visit. Whereas, the “Purchase Offline” half of the ROPO equation for CPG shoppers is likely driven by the fact that many CPG categories like coffee, toothpaste, and diapers need instant replenishment, as soon as they run out. Customers want the immediacy of being able to have these items without any delays, so waiting for online delivery is not an option. Also, speaking of my own experience as a CPG customer, whenever I shop for Cosmetics and Beauty Care products, I want to see, touch, and smell the product first-hand in-store before committing to a purchase.

CPG brands that don’t measure this impact of their online marketing efforts on their offline sales risk reducing the potential sales by disabling online advertising that, at first glance, doesn’t seem to pay off. On the flip side, imagine a scenario where a customer has abandoned his shopping cart on Amazon to make a direct purchase of a Nespresso coffee machine at one of his neighborhood stores. Wouldn’t it be a waste of time and resources to follow up with this customer to make the same purchase online? That’s why you need to collect consumer behavior information from your offline stores and tie it up with your online behavioral data.

“ROPO”: A Significant Marketing Opportunity for CPG Brands

ROPO is an integral part of the buyer’s journey and represents a big opportunity for CPG brands who want to boost in-store sales that result from their digital marketing efforts.

Tracking the ROPO effect can help CPG brands understand:

- Should online channels be more involved in offline campaigns?

- What’s the real return on ad spend of online ad campaigns considering offline purchases?

- What prevents ROPO buyers from initially placing an order online?

- Do their ROPO buyers also make purchases online?

- How can they save on remarketing considering ROPO customers?

Success with digitally savvy ROPO consumers requires more than just offering physical and digital options. It translates to investing in things like search visibility, product content, consumer-generated ratings and reviews, and using them as a leverage to drive in-store traffic for your brand. For example, you can target customers who are researching your products online by inviting them over for in-store demos or product trials. It can be a very effective strategy to boost sales for CPG products that aren’t suited for traditional e-commerce.

As online brand activation across many CPG categories accelerates, investing to catch up—including in search rankings, traffic, reviews, and market share will become increasingly expensive. Eventually, companies that fail to appreciate the urgency to adapt will witness a decline in their sales growth and market share erosion.

Why ROPO Conversions Are a Massive Blind Spot for Digital Marketers

Integrating your data across channels and creating solid attribution techniques are the biggest obstacles in creating effective ROPO strategies. For almost all the websites, the data that is collected is unique to online-only, it is non-PII (personally identifiable information) and anonymous. Whereas, when customers visit our stores, call our phone centers or ring up at our registers, they give us their credit card and their names etc. but not, as an example, their unique persistent cookie id. So, while your online ads are definitely influencing shoppers who complete their purchase offline, how do you track an online visitor who browses and exits the website and then decides to purchase the product later on in the physical store?

Bridging the Gap Between Scattered Online Marketing Data and Offline Sales

Here are some multichannel measurement ideas to help quantify the offline impact of your online presence:

1. Use Google Analytics User-ID Feature

If a large percentage of your customers use a loyalty card in your stores and they log into your site with the same details, you can use Google Analytics’ User-ID feature to accurately track both multi-session, cross-device purchases and in-store purchases. The user would need to be logged in to your site when browsing and then use a loyalty card in-store to make the purchase. The in-store purchase can then be uploaded within Google Analytics and matched up with a User ID.

2. Create and Promote an Engaging Mobile App

Loyalty cards are costly to administer, and many retailers want to move away from them. One way is to replace them with a mobile app. These days, a mobile app (used in conjunction with Beacons) can automatically check a customer in each time they enter your stores. So, you can estimate your ROPO by comparing in-store customer footfalls with their in-app browsing history.

3. Direct Online Traffic and Marketing Efforts Towards Offline Sales

Another way to track ROPO and measure its effectiveness is to set up an experiment in which you use an online geo-marketing campaign to target customers with unique in-store promotions and coupons, and then track the redemption of these through your retail channels.

4. Provide Lead Magnets in Exchange for POS Data

Some of the leading CPG brands have already started offering promotions and contests that can be entered by signing up and providing in-store purchase receipts. For example, Kraft’s cream cheese brand, Philadelphia, worked with the Shopitize app in UK to roll out its customer rewards program. Customers who have downloaded the app and are inside a supermarket can scan bar codes on products and upload pictures of their receipts, which are then automatically processed and validated by the Shopitize mobile ecosystem. Cashback is then instantly credited to their Shopitize account for payout when they reach £5 credits. Other brands using the Shopitize service already include the likes of General Mills, Kellogg’s and United Biscuits as well as several niche players including Aunt Bessie’s and Little Dish.

5. Track Soft ROPO Conversions

Soft ROPO conversions are interactions online visitors have with your website or ad that indicate the likelihood that they will visit your physical store. If you’re already using Google Ads extensions, there are valuable insights you might be able to gather about customers who are researching online before purchasing offline. For example, within the Google Ads interface, we have the ability to view the number of users who click on the call button when the ad is shown on their mobile device. It may be someone calling the store to check opening hours or if they carried out a product-specific search to see if it is in stock. Also, from within the Google Ads interface, you can see how many users clicked to get directions/location details. Again, this metric is a strong indicator that the searcher is looking to visit the store.

Correlating the online behavior of consumers with their offline purchase decisions requires plenty of iterations, time, and effort. An effective ROPO strategy is therefore quite complex to implement and requires the right expertise. The value of doing so however is unquestionable.