I’ve been a loyal gym member for almost 10 years. When I’m not traveling, I’m in the gym 5-6 times a week. The facilities there are great, I have all the equipment I need, and there is a wide selection of classes to choose from—everything from HITT to cycling.

Over the past few months, like many of you, I’ve had to to rethink my exercise regimen. Going to the gym is not an option, and as much as I love running outside, it can get a bit boring on a daily basis. After giving it some thought and hearing endless praise from my friends and colleagues, I purchased a Peloton. Just two weeks later and 14 straight days of riding, I’m a huge fan.

Looking ahead, I’m not quite ready to drop my gym membership, but the value proposition is not as strong. I have a Peloton, yoga mat, and free weights in my home—what else do I really need to stay in shape?

Throughout this pandemic, one of the most visible changes has been the shift in consumer habits, forcing questions such as:

- Are people going to go back to the restaurants as often after improving their cooking skills at home?

- What is the value of a gym membership when you can access live workout classes and made-for-home equipment from your living room?

- Why would anyone risk going to a crowded movie theater if newly-released movies are now available online?

- Is Starbucks worth the money if I just invested in a Nespresso or Breville home appliance?

This Pandemic Will—Eventually—Pass

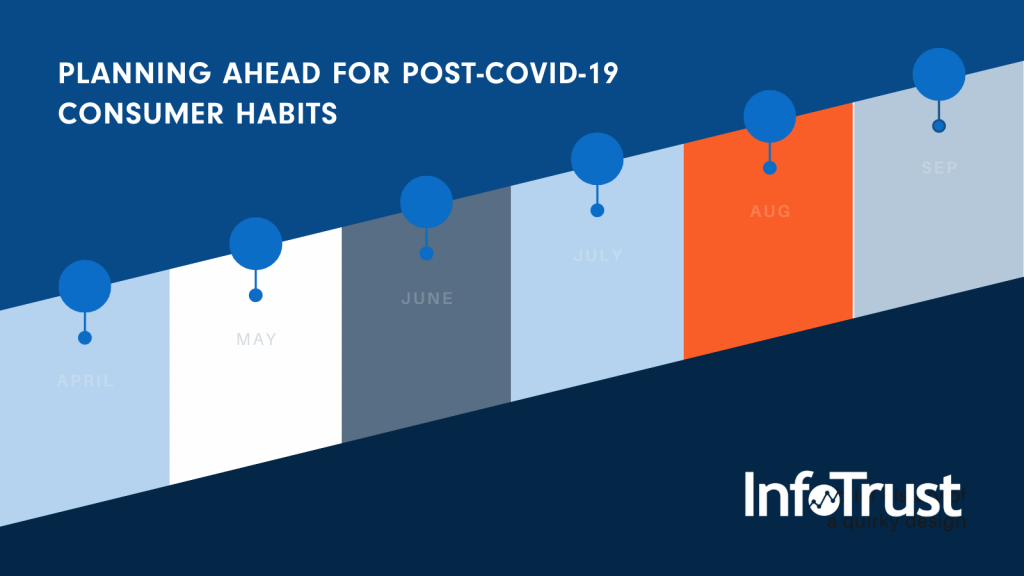

As of early April, many of our partners are beginning to assemble concrete plans for after the COVID-19 crisis is, well, no longer a crisis—when stores open, people begin visiting friends and family, and the world returns to normalcy.

The key change that organizations need to be paying attention to and focusing on is the change in customer habits. If you are Starbucks, the goal is to get people to see coffee as a social experience again; if you’re Nespresso, the goal is to keep new customers and maintain the momentum you likely generated when people were spending most of their time at home.

In the last piece that we published, “Doing More With Less,” our focus was on dealing with immediate budget cuts, marketing spend reallocation, and staying open during this challenging time. In this post, we would like to focus on what’s next: hitting the ground running when things stabilize, whether that’s in 60 or 90 days. To help you prepare now, we’ve provided an “Action” you can take at the end of each section below.

Customer Matrix

To make things simple, we bucketed companies into three segments based on where they are as a result of changing customer habits:

- Excelling: Organizations like Peloton that are benefiting from people staying at home.

- Neutral: Organizations that are in the even state. Their products will be purchased one way or another. Neutrogena, an American skin care, hair care, and cosmetics brand, might fall into this category.

- Hurting: Organizations like airlines, hotel chains, or movie theaters that are not able to deliver their services.

Depending on where your organization is right now, you will need to think differently about how to market yourself as things stabilize. Consider the example below:

1. Focus on Your Competitive Position

We can pretend it’s not the case, but some organizations will see their market position greatly weakened. This presents an opportunity for organizations that are in a stronger position to put their foot on a gas and acquire new customers.

Consider what irresistible offer you can put in front of new prospects that share the qualifications of your best customer types. We’re not advocating for large, one-time sales only; we instead push to attract customers that you may be able to retain long-term.

Merchandise intensity in a brick-and-mortar store is measured by how many dollars the retailer has invested per square foot at cost in inventory. Higher sales per square foot is typically the result of higher merchandise intensity. This is certainly only true to a point, whereas additional inventory eventually becomes counterproductive.

Looking at this concept from the view of the customer, one must think about the point of going into a store if that store doesn’t have the items you want in your size. In 1992, the year before Macy’s went into Chapter 11 bankruptcy, the company reduced their inventory 18%; their sales fell 18% that same year.

As organizations look for ways to save money, their customer experience may diminish. This is an opportunity for your organization to overdeliver and heavily promote your competitive advantage.

Action: This is not about doing harm to other companies, but rather about building up your own competitive advantage when other competitors may be weakened. Analyze the list of your competitors and where they stand amidst this crisis based on their stocks and other metrics—then determine which ones have customers that are open to a change.

2. Prepare Your Teams For Hard Questions

Even after the COVID-19 crisis, sales and service professionals are likely to encounter customers who are stressed out, afraid, and still concerned. For example, should you plan to have hand sanitizers in your stores when they do reopen? On one hand, customers might appreciate that you are taking their health seriously; on the other, this might create additional anxiety. Leaders and managers need to create an accessible communication plan with talking points and action steps to prepare frontline teams to handle these difficult situations.

Over the past few months, it has become normal to see a letter from the CEO on a retail website. Here is an example from Lululemon Athletica:

Action: Develop your post-crisis communication strategy and determine what long-term changes might look like. Stores will eventually open back up, but customers may still prefer to shop online—they have already been trained to do so.

3. Rethink Your Customer Lifetime Models

Customer lifetime value, or CLV, is a key metric that represents how much cash the average customer spends during their relationship with a company—in other words, how much they’re worth to a business. Over the past few months, your most loyal customers likely stayed with you—they purchased your products and services online, if the option was available, and likely they are going to purchase from you when stores reopen. Ask your team:

- What about customers that have not purchased from us over these past few months?

- Is there a chance this audience left and moved their money elsewhere?

- Do we know who they are or why they left?

- Where did they go?

- If so, are they worth getting back?

It’s easy to think that it’s important to target all the customers that churn, but maybe this is an opportunity to double-down on the segment that stayed with you over this period of time and overdeliver to them.

There is a great chance that over this time, you also gained some new customers that are likely to stay when things get better. How can you reward them in the long-run and make their new habit permanent?

Action: Review your CLV models and determine how and what might need to be adjusted so you don’t chase customers that left you and have no plans of returning. This will free up marketing dollars and space to act on the right customer segments.

4. Plan to Offset Impulse Sales

Whether it’s buying enough toilet paper to last a year or purchasing your next pair of running shoes simply because they’re discounted now, it’s likely that across some segments, customers are buying products that will last them for a long period of time. This removes the need to buy again in the shorter time-frame. Personally, I just purchased two pairs of tennis shoes because they were advertised at a steep discount. Many retailers are struggling, and they’re happy to generate some cash now to survive.

Action: Reevaluate your forecasting models and determine how future sales will be impacted by the demand that consumers are “artificially” generating today. It’s time to determine if steep discounts are going to hurt you down the road.

The Time to Plan is Now

At the end of the day, there is unfortunately no right answer as to how to get yourself ready for a “comeback.” Our hope is that these ideas help you consider the next phase of your business, as only focusing on getting through the COVID-19 crisis may create challenges in the future when things get better. Avoid the trap of short-sightedness; balance what you need to be doing today with what you want your business to look like 60 days from now.