Multi-brand, consumer packaged goods, fast-moving consumer goods: in two out of these three frequently-used terms that describe my absolute favorite vertical, the “consumer” is literally at the centre of the experience. Yet, do we really know who they are?

In the world of analytics, what we often do is focus on what the consumer did—attempting to use their behaviour on-site to understand why they did what they did and how we can help improve their experience—all so we can get more value in return for our ad dollars.

Nothing Without the "Who"

I’m about to make an extremely radical proposition: Analytics is nothing without the who.

Many analysts and analytics experts are probably shaking their heads at this very moment, saying that demographics and psychographics reveal nothing substantial about the consumer; (nothing actionable, at least!). I say that, in today’s world, consumers are one of the most complex aspects of the business. Even more so given the plethora of stimuli we are exposed to on a daily basis. Forget logistics, sales, weather, economy; what determines whether I buy one product or a specific brand is very often an individualistic lifestyle and situational decision, highly dependent on my demographics and psychographics.

Where Do We Get Information About This "Who"?

There are plenty of second and third-party sources to gain information about your potential individual consumers or groups of consumers (also known as your target audience if you speak media or user experience or optimization). To name just a few, you could look into: Target Group Index, Web Index, BRANDpuls, Google Consumer Barometer, social listening tools (Hootsuite, Brandwatch, etc.), Google Audience Center, or even audiences on other media platform’s (Display & Video 360 audience module, Facebook, Twitter, Snap audience manager).

The Treasure Within Google Analytics

Did you know that you have a treasure trove right at your fingertips with Google Analytics (GA)? If you’re on a marketing or brand team in any capacity, chances are you have access to the GA property for your website. The beauty of that is:

- It’s your very own audience, not a group of people who are similar to what you would look for in a potential site visitor/engager/consumer);

- It can be drilled down to whatever level of granularity you are after, unlike other platforms that are limited to aggregation, and;

- It includes rich behavioural data custom to your product and your website alone, unlike other sources that either lack this data altogether (think syndicated consumer surveys that happen to not include a specific brand variant you are curious about) or are highly sampled or catered to one area of the purchase funnel (think of that advertising pixel that only captures lands on your new-to-company product page).

Google Analytics Reports to Help You Get to Your "Who"

With that in mind, here are a couple of easy ways you can use Google Analytics to learn more about the who behind your CPG consumer:

Demographics and Psychographics first!: Remember how I made that extremely radical proposition early on by saying we need to get to the demographics and psychographics of our consumers to understand their behaviors? Well, that hasn’t changed! Particularly for CPG brands, we recommend digging deep into audience reports. Why? Because this reveals insights into the people who went onto your site – people who want to learn more about your brand. They are curious, actively researching and considering a product/brand that could otherwise very well be an impulse purchase.

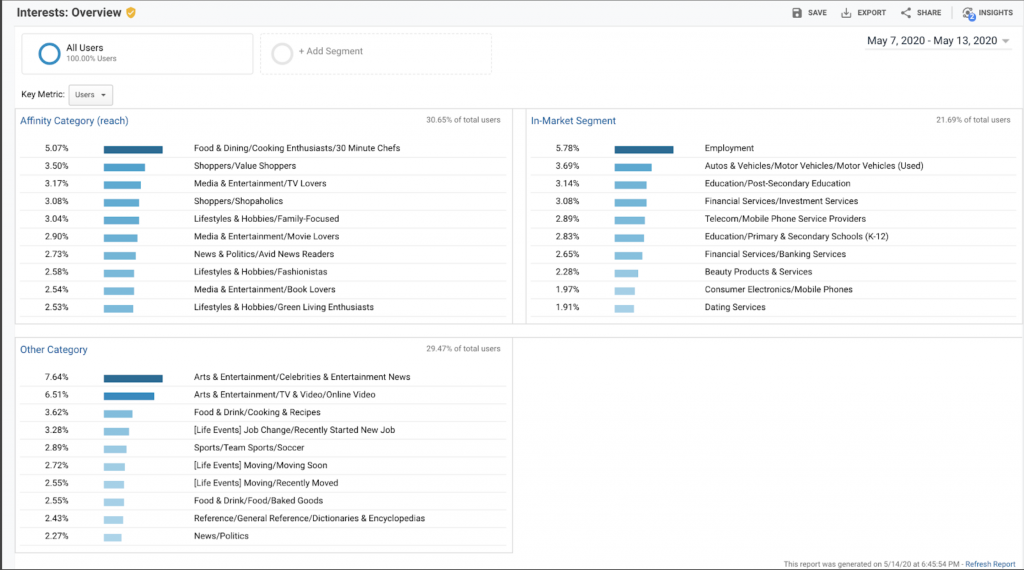

- The Audiences > User Explorer Report will be your best friend. My colleague has written this article to help you get started with exploring your on-site consumers and their unique demographics (Age groups, gender, geography, device, browser) and psychographics (User Interests, Affinity Categories, In-Market Segments) are easily available here.

- The granularity of your audiences can be as generic or specific as you’d like:

- Do you want to see what one specific person did on your website? You can do this with the gaClient ID, which is a cookie-based ID that will need to be first set up programmatically to get it into GA. You can then use that gaClient ID as a secondary dimension in standard or in custom reports and follow him/her around as you acquire , engage with and convert him/her on your site (NB: gaClientID is not a logged-in database, but is cookie-based. In A+W properties, currently in beta, google’s graph of logged-in users are used to maintain fidelity across all Google-platforms (including any GMP platforms linked if you’re a GA360 user)

- Use cohort analysis and frequency/recency reports to observe cohort behavior and identify if your site improvements and/or marketing campaigns are more effective in the short or long-term.

- Segment, Segment, Segment. Then explore them like crazy to see what paid and organic media got them to the site, what they did on the site and how you can get more of them onto your site.

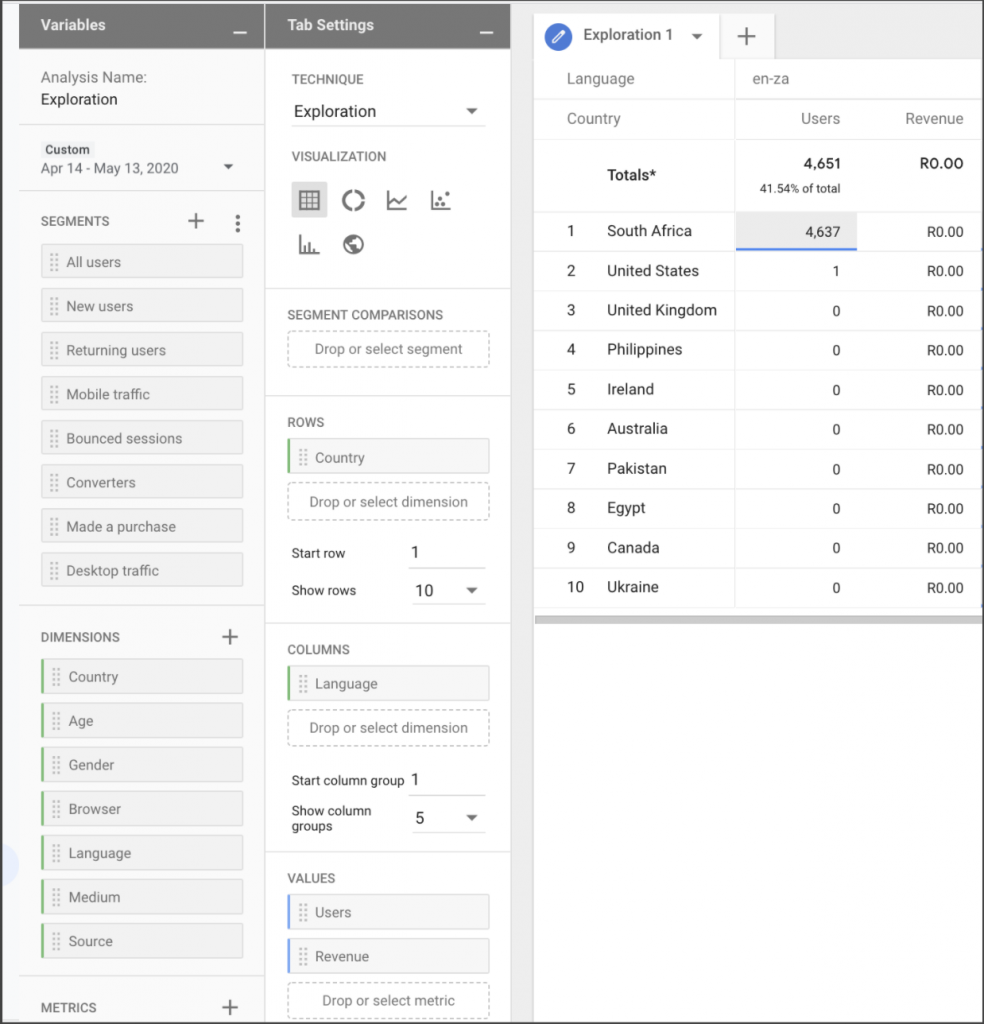

- Use custom reports, and the Exploration Function within Analysis (Beta) to slice and dice your data however you’d like. The more you explore, the more will be revealed.

- The granularity of your audiences can be as generic or specific as you’d like:

Offline purchases don’t have to be a bottleneck to your insight-gathering: One thing about the CPG vertical is that the vast majority of purchases happen offline at your local Walmart or even a convenience store. But does that mean you cannot do any form of revenue, return on spend or lifetime value analysis on your consumers with your online data to get to know them better? That would be a resounding NO!

In fact, GA has some great functionalities that allow you to get super creative and get all the answers you need:

- Consumer Data Import: CRM data, VR codes scanned, loyalty information. You name it and it can be imported. All you need is a linker that can be anything from your customer login ID (if you have a specific member’s only area on-site that has unique offers), loyalty card ID, or even a CRM ID (preferably SalesForce) that gets associated with the customer or their gaClientID.

- Media Cost Data Import : using the same functionality of data import, you can get your offline media spends (mailers, billboards, etc) imported in and associated with campaigns and time periods for a fairly decent return on ad spend analysis. Add in your product manufacturing costs to get an even more accurate analysis. Our Data Science team can help you get started!

- While actual offline CPG purchases may not be readily available in GA, one element that often gets overlooked is tracking coupons or offer downloads. In addition to clicks to e-retailers (Buy Now buttons) or clicks to find a store (Store Locator buttons) in your area, tracking coupon downloads using custom events in GA (Behavior>Events Report) are an extremely valuable way to understand consumer intent to purchase. If you can retrieve the IDs of coupons redeemed from your POS system and import them back into GA, you can even identify your coupon-to-sale conversion ratio and use it to get a fairly reasonable prediction of future sales.

Understanding the user journey on-site and using that to identify the Who: Your consumers are not defined just by where they’re from and what they like to do and say. This is probably my favourite part of working in CPG (and sometimes the most irksome part)- that consumers don’t have a typical journey flow and it takes a lot of poking around in GA to understand them better. Here are 2 of my favourite reports:

- Navigation Summary: Particularly if you have content groups set up to bucket sections of your site, this can be an illuminating report that tells you exactly where a significant number of your consumers like to go after reading that recipe you just posted or after landing on your awesome competition page and filling out the form. Want to see it more visually and don’t mind sampled data? Go for the Behaviour Flow or Users Flow report instead.

- Reverse Goal Path (needs Goals to be set up for various key events or destination pages) : This is very interesting to explore when trying to narrow down actions users take that lead them to that prized membership sign-up or click to your retailer partner.

Using both the above reports, I’ve been able to group visitors to various sites belonging to our CPG clients as one of the below categories and use that as a starting point for further exploration and testing of site content and marketing endeavors:

- Online window shoppers (look at your products but never complete a micro-conversion or macro-conversion)

- Researchers (spend hours reading product details and comparing)

- Serial coupon downloaders (download but never use – I call these the value-seekers),

- Bouncers (Land and leave )

- The confused ones (go back and forth between the same sections and eventually leave the website in frustration- these are the best groups to observe or gather feedback from further using Google Surveys or a Site user tracking or Heat-mapping tool such as SessionCam to improve your site UX)

- the loyal ones (regularly visit your site and check out new offerings, often converting as well) and

- the I-know-what-I-want group (Go straight to their product of interest and purchase, often don’t need to use coupons)

As you can see, your CPG consumer is not as mysterious and difficult to understand as you think.

So get started today, and let us help you use Google Analytics to solve your unique CPG challenges, starting with the Who!